E-filing of trademark applications has made the entire trademark registration process much more straightforward and less time-consuming for businesses seeking to protect their intellectual property.

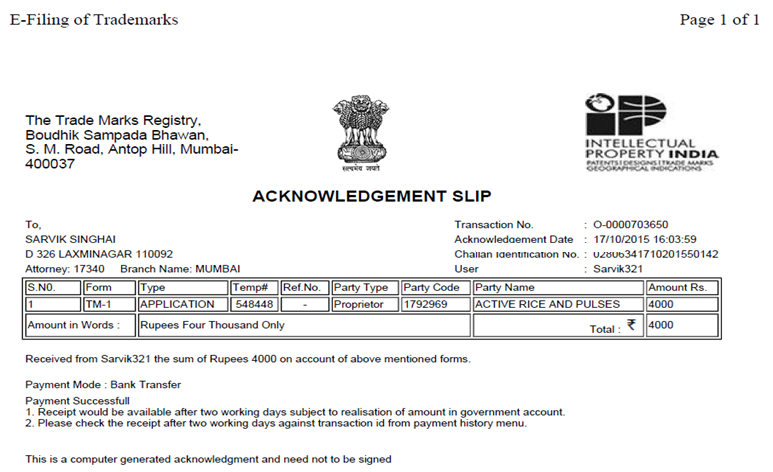

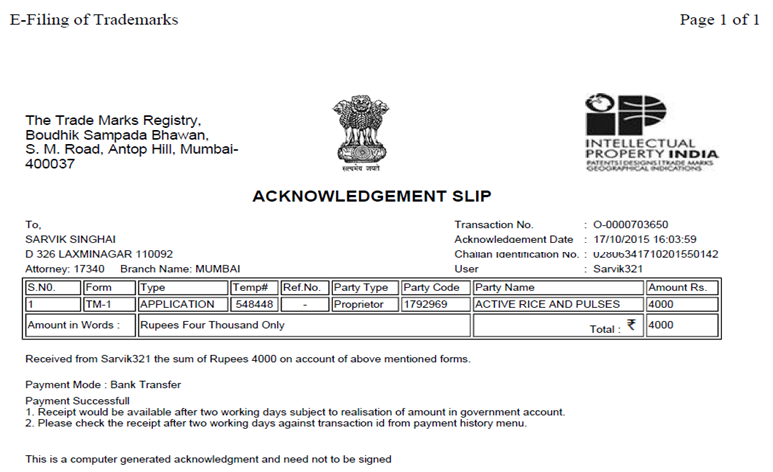

Once your trademark application is submitted, you’ll receive an acknowledgment receipt along with a Permanent Trademark Number. This number allows you to monitor the status of your application as it progresses.

Step 1:

After receiving the acknowledgment (screenshot provided) from our team, please allow up to two working days for the government portal to reflect your application online.

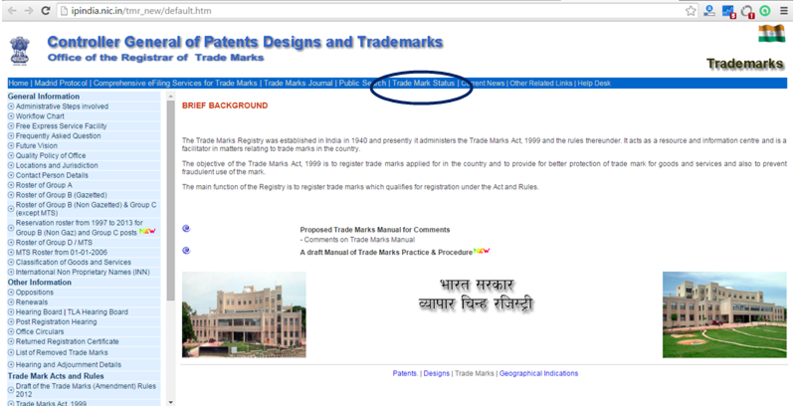

Step 2:

After 2 days, visit www.ipindia.nic.in, and click on the trademark link gift on the red bar that is highlighted in the screenshot below.

Step 3:

Then this link can take you to next web page http://ipindia.nic.in/tmr_new/default.htm. Find the ‘Trade Mark Status’ tab on the blue bar and click on thereon.

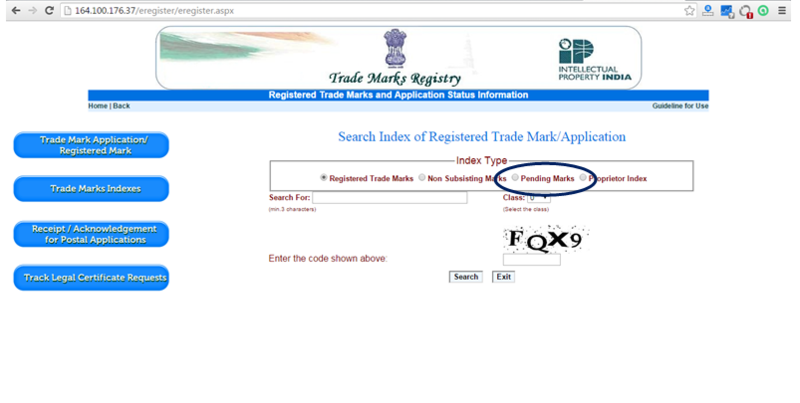

Step 4:

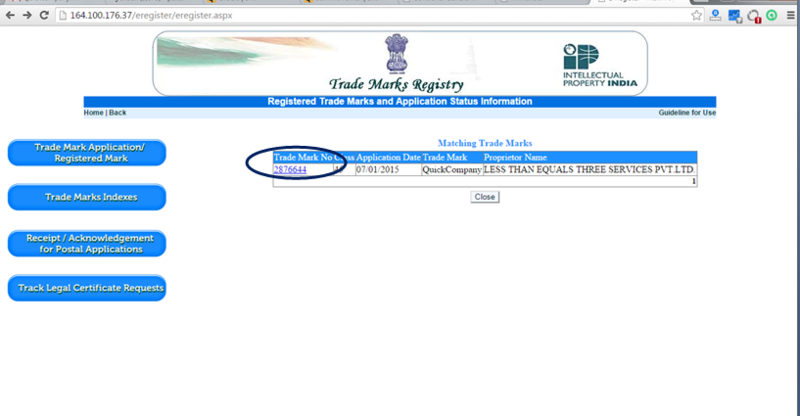

After clicking on the trademark standing tab, the link can take you to http://164.100.176.37/eregister/eregister.aspx, find the Trademarks Indexes Tab on the left aspect of the page and click on thereon.

Step 5:

Now on following a page that seems to settle on the unfinished Marks out of the four Index varieties out there, subsequently you would like to fill the Trademark details and choose category during which your trademark is filed. Fill the captcha and your trademark details are going to be mirrored on the website:

Step 6:

Here is that the window that may mean your fill all the right details of trademark: to induce the total details, simply click on the trademark variety.

Step 7:

After you click on the {tm|thulium|Tm|atomic variety 69|metallic element metal} number, all the small print regarding the standing of the trademark application are going to be mirrored on the website.

In case of any specific question, you will contact our specialists anytime on

The Reverse Charge Mechanism (RCM) is a tax collection method under GST where the recipient of goods or services, instead of the supplier, is responsible for paying the GST directly to the government.

RCM applies to transactions such as legal services, goods transport agencies (GTA), e-commerce operators for certain transactions, import of services, and purchases from unregistered suppliers.

Yes, businesses can claim ITC on RCM payments. They must first pay the GST liability, report it in GSTR-3B, and then claim ITC in the subsequent eligible return.

Under RCM, businesses must pay GST upfront, which can create short-term cash flow constraints. However, they can later claim ITC to offset this cost.

Businesses must issue self-invoices, pay GST on applicable transactions, report RCM transactions in GSTR-1 and GSTR-3B, and maintain digital records as per updated compliance standards.

Failure to comply with RCM regulations can lead to higher penalties, interest on unpaid tax, and stricter audits as per the revised GST laws in 2025.

Key updates include expanded coverage of digital and gig economy services, automated verification for RCM payments, stricter penalties for non-compliance, and simplified ITC claim processes.